해당 자료는 전북대학교 이영미 교수님 2023고급시계열분석 자료임

library (lubridate)library (ggplot2)library (car)#library(forecast) library (lmtest)

Attaching package: ‘lubridate’

The following objects are masked from ‘package:base’:

date, intersect, setdiff, union

Loading required package: carData

Loading required package: zoo

Attaching package: ‘zoo’

The following objects are masked from ‘package:base’:

as.Date, as.Date.numeric

1

<- c (52 ,46 ,46 ,52 ,50 ,50 ,48 ,45 ,41 ,53 )<- length (z)

(3)

sum ((z- mean (z))^ 2 )= sum ((z- mean (z))^ 2 )/ (n-1 )

130.1

14.4555555555556

+ qt (0.975 ,(n-1 )) * sqrt ((1 + 1 / n)* s2)- qt (0.975 ,(n-1 )) * sqrt ((1 + 1 / n)* s2)

57.3206225347423

39.2793774652577

- lm함수 비교

Call:

lm(formula = z ~ 1)

Residuals:

Min 1Q Median 3Q Max

-7.3 -2.3 0.7 3.2 4.7

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 48.300 1.202 40.17 1.83e-11 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 3.802 on 9 degrees of freedom

predict (m, newdata= data.frame (t= 11 : 15 ), interval= "prediction" )

A matrix: 5 × 3 of type dbl

1

48.3

39.27938

57.32062

2

48.3

39.27938

57.32062

3

48.3

39.27938

57.32062

4

48.3

39.27938

57.32062

5

48.3

39.27938

57.32062

2

(3)

<- c (303 ,298 ,303 ,314 ,303 ,314 ,310 ,324 ,317 ,327 ,323 ,324 ,331 ,330 ,332 )<- length (z)

= 2 * (2 * n+ 1 )/ n/ (n-1 ) * sum (z) - 6 / n/ (n-1 )* sum (t* z)= 12 / n/ (n^ 2-1 )* sum (t* z) - 6 / n/ (n-1 )* sum (z)

297.780952380952

2.3857142857143

(4)

\(\hat Z_n(l) = \hat \beta_0 + \hat \beta_1(n+l)\)

+ hat_beta_1 * (15 + (1 : 5 ))

335.952380952381 338.338095238095 340.72380952381 343.109523809524 345.495238095238

- lm비교

Call:

lm(formula = z ~ t)

Residuals:

Min 1Q Median 3Q Max

-6.710 -2.331 -1.181 2.519 7.133

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 297.781 2.364 125.964 < 2e-16 ***

t 2.386 0.260 9.176 4.84e-07 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 4.351 on 13 degrees of freedom

Multiple R-squared: 0.8662, Adjusted R-squared: 0.856

F-statistic: 84.19 on 1 and 13 DF, p-value: 4.836e-07

predict (m, newdata = data.frame (t= 15 + (1 : 5 )), interval= "prediction" )

A matrix: 5 × 3 of type dbl

1

335.9524

325.2553

346.6495

2

338.3381

327.3932

349.2830

3

340.7238

329.5084

351.9393

4

343.1095

331.6025

354.6166

5

345.4952

333.6771

357.3134

3

note: 모의시계열 표본평균과 표본분산을 안구했었네!;

<- 1 : 100 ####### (1) <- 100 + rnorm (100 ,0 ,1 )####### (2) <- 500 + rnorm (100 ,0 ,1 )####### (3) <- 100 + rnorm (100 ,0 ,10 )####### (4) <- 100 + t * rnorm (100 ,0 ,1 )

<- data.frame (Zt_1 = Zt_1,Zt_2 = Zt_2,Zt_3 = Zt_3,Zt_4 = Zt_4)round (colMeans (dt),2 )round (apply (dt,2 ,var),2 )

Zt_1 100.04 Zt_2 499.98 Zt_3 100.45 Zt_4 95.8

Zt_1 1.05 Zt_2 0.84 Zt_3 89.68 Zt_4 2449.71

ts.plot (ts (Zt_1), ts (Zt_2), ts (Zt_3), ts (Zt_4),lwd= 2 ,col= 1 : 4 )legend (c (0 ,450 ), legend = c (expression (Z[t1]), expression (Z[t2]), expression (Z[t3]),expression (Z[t4]),col= 1 : 4 , bty= 'n' , lty= 1 , lwd= 2 )

ERROR: Error in parse(text = x, srcfile = src): <text>:6:0: unexpected end of input

4: legend(c(0,450), legend = c(expression(Z[t1]), expression(Z[t2]), expression(Z[t3]),expression(Z[t4]),

5: col= 1:4, bty='n', lty=1, lwd=2)

^

4

###### (1) <- 100 + rnorm (100 ,0 ,1 )####### (2) <- 100 + t + rnorm (100 ,0 ,1 )####### (3) <- 100 + 0.3 * t + sin (2 * pi* t/ 12 ) + cos (2 * pi* t/ 12 ) + rnorm (100 ,0 ,1 )

Warning message in 100 + t + rnorm(100, 0, 1):

“longer object length is not a multiple of shorter object length”

Warning message in 100 + 0.3 * t + sin(2 * pi * t/12) + cos(2 * pi * t/12) + rnorm(100, :

“longer object length is not a multiple of shorter object length”

ts.plot (ts (Zt_1), ts (Zt_2), ts (Zt_3),col= 1 : 3 , lwd= 2 )legend ("topleft" , legend = c (expression (Z[t1]), expression (Z[t2]), expression (Z[col= 1 : 3 , lty= 1 , lwd= 2 )

<- 100 + 0.3 * t + 3 * sin (2 * pi* t/ 12 ) + 20 * cos (2 * pi* t/ 12 ) + rnorm (100 ,0 ,1 )ts.plot (ts (Zt_1), ts (Zt_2), ts (Zt_3),col= 1 : 3 )legend ("topleft" , legend = c (expression (Z[t1]), expression (Z[t2]), expression (Z[col= 1 : 3 , lty= 1 )

5

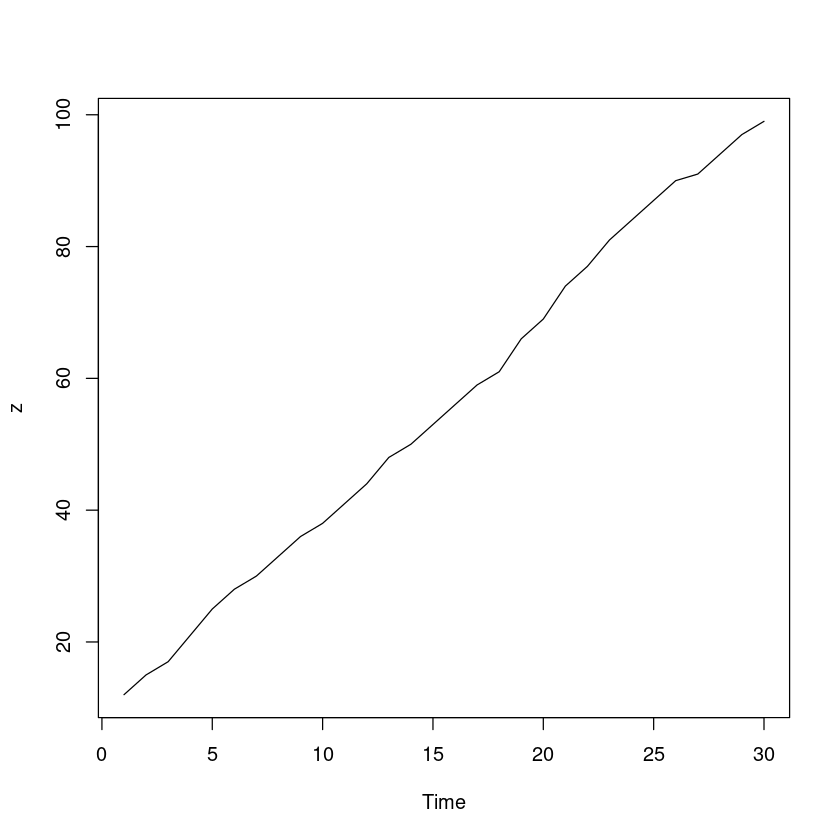

<- scan ("book.txt" )plot.ts (z)

(3)

\(Z_t = \beta_0 + \beta_1 t + \epsilon_t\)

<- 1 : length (z)<- lm (z~ t)summary (m)

Call:

lm(formula = z ~ t)

Residuals:

Min 1Q Median 3Q Max

-2.5563 -1.0063 -0.2081 1.0385 2.0644

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 8.19080 0.46960 17.44 <2e-16 ***

t 3.07586 0.02645 116.28 <2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 1.254 on 28 degrees of freedom

Multiple R-squared: 0.9979, Adjusted R-squared: 0.9979

F-statistic: 1.352e+04 on 1 and 28 DF, p-value: < 2.2e-16

(4)

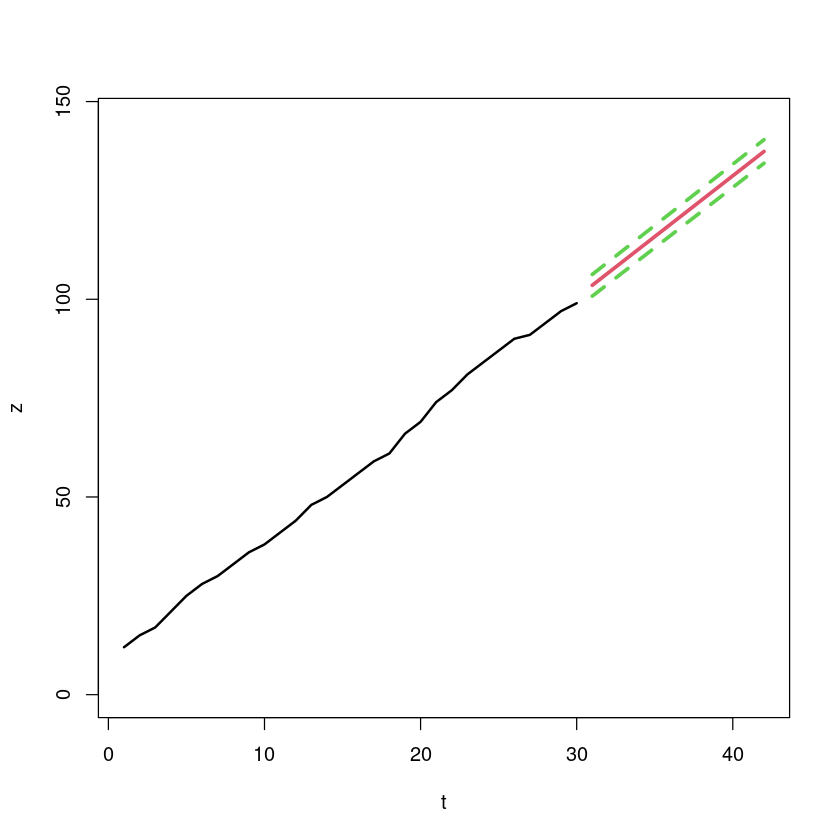

\(\hat Z_{n+l} = \hat Z_n(l) = \hat \beta_0 + \hat \beta_1(n+l)\)

<- data.frame (t= 30 + (1 : 12 ))predict (m, new_dt)

1 103.542528735632 2 106.618390804598 3 109.694252873563 4 112.770114942529 5 115.845977011494 6 118.92183908046 7 121.997701149425 8 125.073563218391 9 128.149425287356 10 131.225287356322 11 134.301149425287 12 137.377011494253

<- predict (m, new_dt, interval= "prediction" )

A matrix: 12 × 3 of type dbl

1

103.5425

100.7996

106.2855

2

106.6184

103.8584

109.3784

3

109.6943

106.9162

112.4723

4

112.7701

109.9731

115.5671

5

115.8460

113.0291

118.6629

6

118.9218

116.0842

121.7595

7

121.9977

119.1384

124.8570

8

125.0736

122.1918

127.9554

9

128.1494

125.2443

131.0546

10

131.2253

128.2960

134.1546

11

134.3011

131.3469

137.2554

12

137.3770

134.3970

140.3570

plot (t, z, type= 'n' , ylim = c (0 , 145 ), xlim= c (1 ,(30 + 12 )))lines (t, z, lwd= 2 )lines (30 + (1 : 12 ), pred[,1 ], col= 2 , lwd= 3 )lines (30 + (1 : 12 ), pred[,2 ], col= 3 , lwd= 3 , lty= 2 )lines (30 + (1 : 12 ), pred[,3 ], col= 3 , lwd= 3 , lty= 2 )

6

<- scan ("export.txt" )<- length (z)

86

<- ts (z, frequency= 12 )cycle (z_ts)

A Time Series: 8 × 12

1

1

2

3

4

5

6

7

8

9

10

11

12

2

1

2

3

4

5

6

7

8

9

10

11

12

3

1

2

3

4

5

6

7

8

9

10

11

12

4

1

2

3

4

5

6

7

8

9

10

11

12

5

1

2

3

4

5

6

7

8

9

10

11

12

6

1

2

3

4

5

6

7

8

9

10

11

12

7

1

2

3

4

5

6

7

8

9

10

11

12

8

1

2

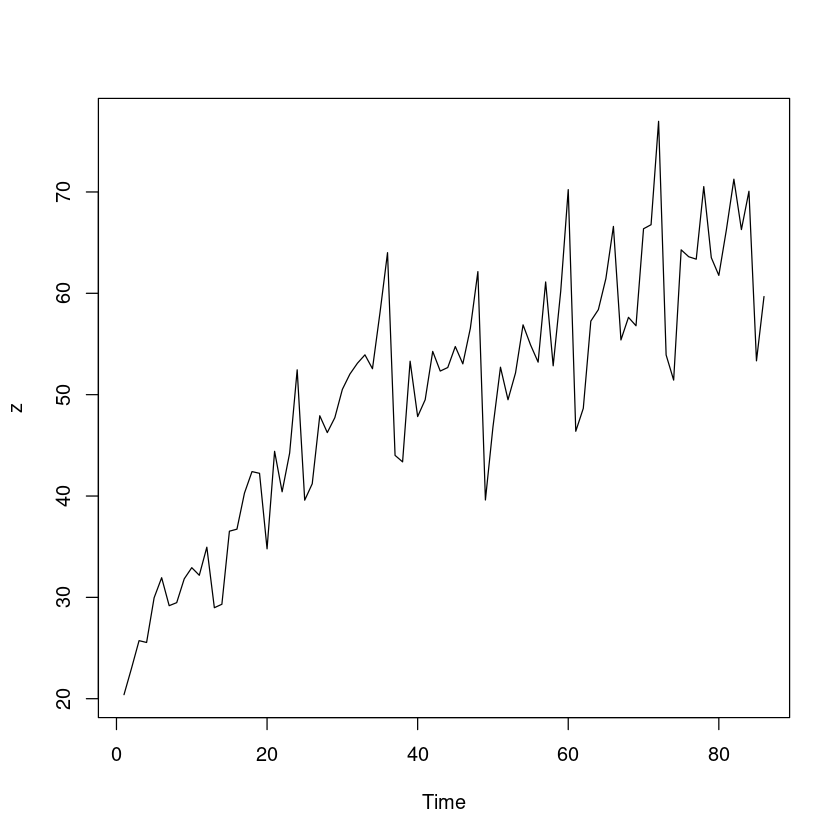

추세성분, 계절성분(주기=12), 불규칙 성분으로 구성되어 있음

계절추세모형

\(Z_t = \beta_0+ \beta_1t + \sum_{i=1}^12 \delta_i \times I_{t1} + \epsilon_t\) , 단 \(\delta_1=0\)

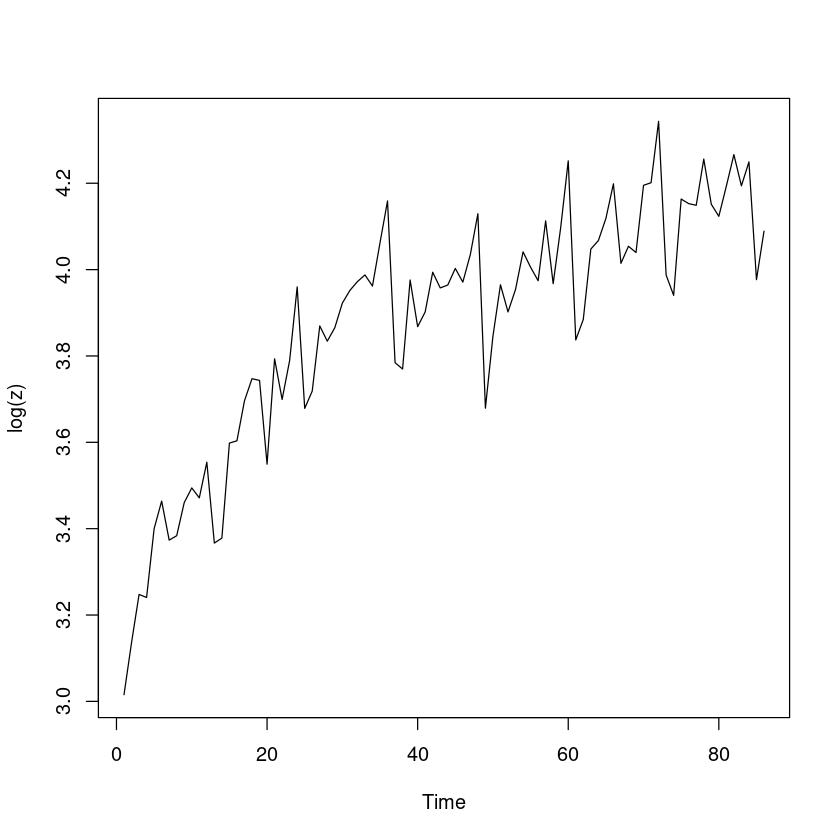

note: 나는 로그변환 한 값을 넣었음

<- ts (z, frequency= 12 )cycle (z_ts)

A Time Series: 8 × 12

1

1

2

3

4

5

6

7

8

9

10

11

12

2

1

2

3

4

5

6

7

8

9

10

11

12

3

1

2

3

4

5

6

7

8

9

10

11

12

4

1

2

3

4

5

6

7

8

9

10

11

12

5

1

2

3

4

5

6

7

8

9

10

11

12

6

1

2

3

4

5

6

7

8

9

10

11

12

7

1

2

3

4

5

6

7

8

9

10

11

12

8

1

2

<- as.factor (cycle (z_ts))<- 1 : n<- lm (z~ t+ seasonal_I)

Call:

lm(formula = z ~ t + seasonal_I)

Residuals:

Min 1Q Median 3Q Max

-10.8562 -2.2938 0.1567 2.6730 9.3951

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 21.98000 1.73500 12.669 < 2e-16 ***

t 0.43721 0.01893 23.097 < 2e-16 ***

seasonal_I2 1.71779 2.16697 0.793 0.430512

seasonal_I3 9.21741 2.24422 4.107 0.000103 ***

seasonal_I4 7.37163 2.24366 3.286 0.001566 **

seasonal_I5 9.30299 2.24326 4.147 8.98e-05 ***

seasonal_I6 12.96578 2.24302 5.780 1.72e-07 ***

seasonal_I7 9.16286 2.24294 4.085 0.000112 ***

seasonal_I8 7.73422 2.24302 3.448 0.000941 ***

seasonal_I9 11.07272 2.24326 4.936 4.88e-06 ***

seasonal_I10 10.68409 2.24366 4.762 9.47e-06 ***

seasonal_I11 12.37545 2.24422 5.514 5.03e-07 ***

seasonal_I12 18.57967 2.24494 8.276 4.26e-12 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 4.334 on 73 degrees of freedom

Multiple R-squared: 0.9011, Adjusted R-squared: 0.8848

F-statistic: 55.4 on 12 and 73 DF, p-value: < 2.2e-16

적합된 모형: \(\hat Z_t = 21.98 + 0.437t + 1.72 I_{t2} + 9.22 I_{t3} + \dots 18.58 I_{t12}\)

(4) 모형설명(제약조건 주의!)

1개월이 지날 때마다 월별수출액은 평균적으로 0.437억$증가

2월은 1월에 비해 월별수출액이 1.72억$ 증가

3월은 1월에 비해 월별수출액이 9.22억$ 증가

…

12월은 1월에 비해 평균 월별수출액이 18.58억$ 증가

(5)

\(\hat Z_{n+l} = \hat Z_n(l) = \hat \beta_0 + \hat \beta_1(n+l) + \sum_{i=1}^{12} \delta_i I_{t1}\)

<- data.frame ( t = n + (1 : 12 ),seasonal_I = as.factor (c (3 : 12 ,1 ,2 )))

A data.frame: 12 × 2

<int>

<fct>

87

3

88

4

89

5

90

6

91

7

92

8

93

9

94

10

95

11

96

12

97

1

98

2

(6) 95% 예측 구간

1 69.2346153846154 2 67.8260439560439 3 70.1946153846154 4 74.2946153846154 5 70.9289010989011 6 69.9374725274725 7 73.7131868131868 8 73.7617582417582 9 75.8903296703297 10 82.5317582417582 11 64.3892994505495 12 66.5442994505494

<- predict (m2, new_dt, interval = 'prediction' )

A matrix: 12 × 3 of type dbl

1

69.23462

59.82517

78.64407

2

67.82604

58.41659

77.23549

3

70.19462

60.78517

79.60407

4

74.29462

64.88517

83.70407

5

70.92890

61.51945

80.33835

6

69.93747

60.52802

79.34692

7

73.71319

64.30374

83.12264

8

73.76176

64.35231

83.17121

9

75.89033

66.48088

85.29978

10

82.53176

73.12231

91.94121

11

64.38930

55.00439

73.77421

12

66.54430

57.15939

75.92921

69.23462 = \(\hat Z_{87} = \hat Z_{86}(1) = \hat \beta_0 + \hat \beta_1 \times 87 + \delta_3 \times I_{87 \times 3}\) (3월)

70.92890 = $ Z_{86}(5) = _0 + _1 (86+5) + 7 I {91 }$ (7월)

(7)

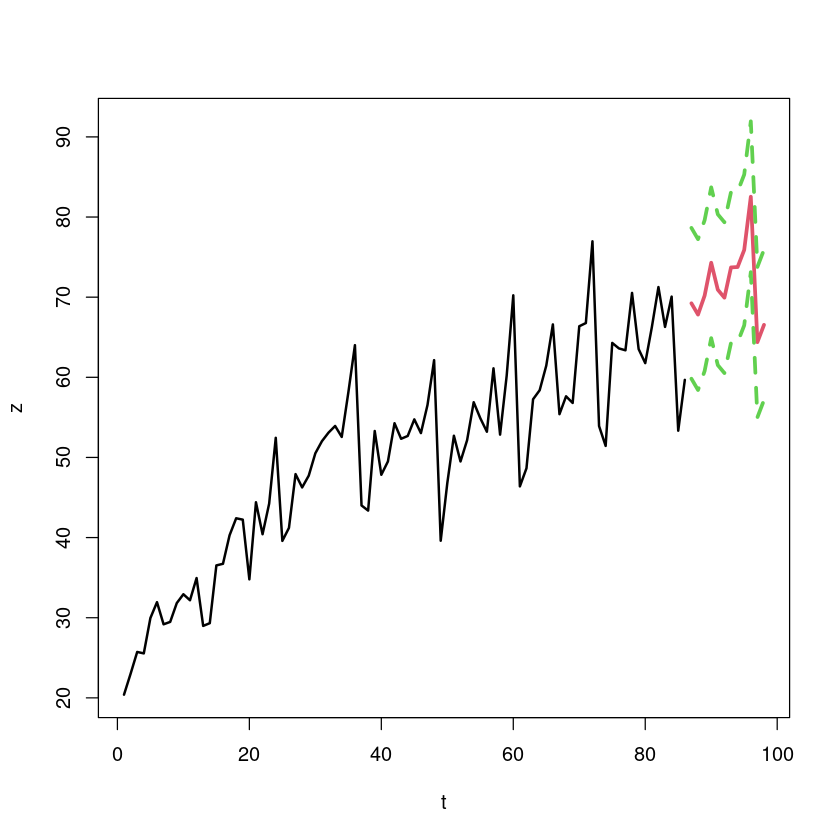

<- min (c (z, pred[,2 ]))<- max (c (z, pred[,3 ]))plot (t, z, type= 'n' , ylim = c (min_, max_), xlim= c (1 ,(n+ 12 )))lines (t, z, lwd= 2 )lines (n+ (1 : 12 ), pred[,1 ], col= 2 , lwd= 3 )lines (n+ (1 : 12 ), pred[,2 ], col= 3 , lwd= 3 , lty= 2 )lines (n+ (1 : 12 ), pred[,3 ], col= 3 , lwd= 3 , lty= 2 )

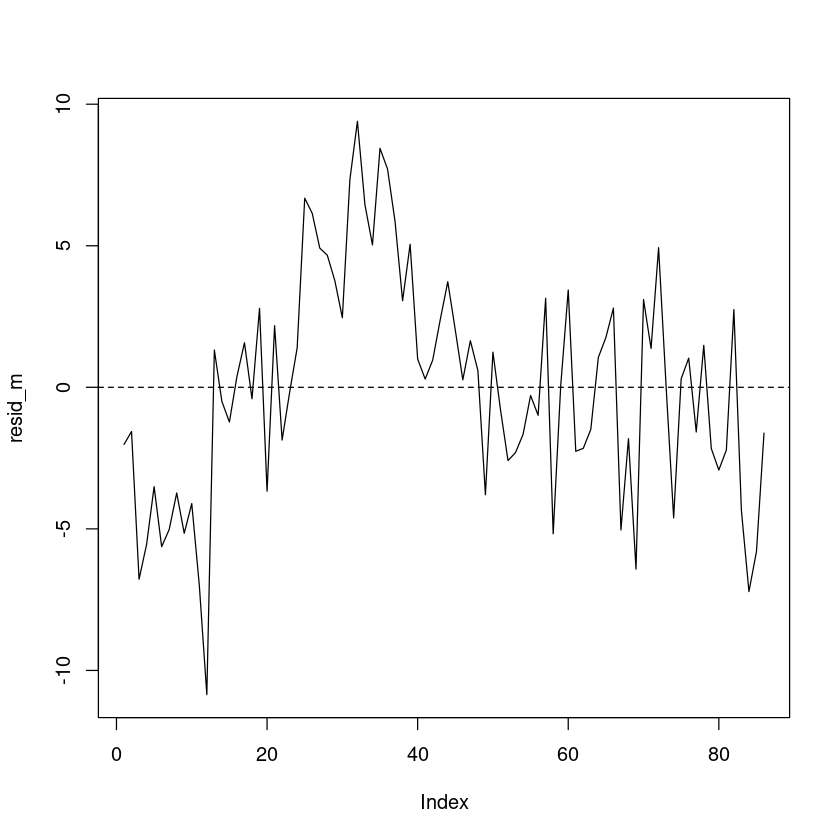

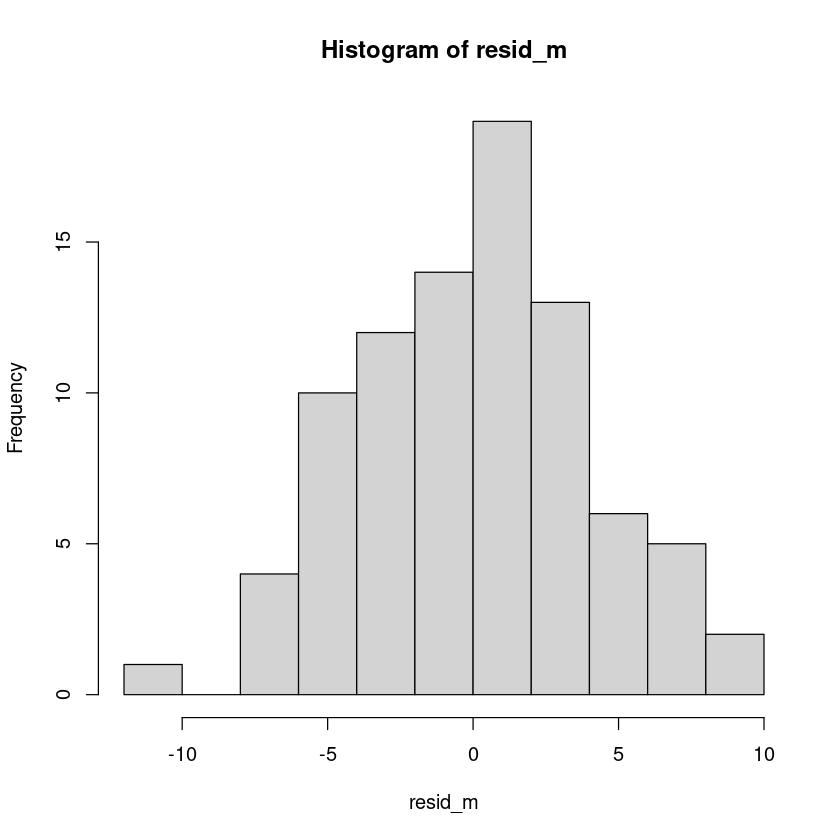

(번외) 잔차검정

<- resid (m2)plot (resid_m, pch= 16 , type= 'l' )abline (h= 0 , lty= 2 )

One Sample t-test

data: resid_m

t = 2.6111e-16, df = 85, p-value = 1

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-0.861081 0.861081

sample estimates:

mean of x

1.130835e-16

studentized Breusch-Pagan test

data: m2

BP = 18.466, df = 12, p-value = 0.1023

:: dwtest (m2, alternative= "two.sided" )

Durbin-Watson test

data: m2

DW = 0.79196, p-value = 5.014e-09

alternative hypothesis: true autocorrelation is not 0

다항추세 사용

<- lm (z ~ t + I (t^ 2 ) + seasonal_I)summary (m3)

Call:

lm(formula = z ~ t + I(t^2) + seasonal_I)

Residuals:

Min 1Q Median 3Q Max

-9.2252 -2.1156 0.0414 2.2895 7.5664

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 17.3011107 1.6527443 10.468 4.12e-16 ***

t 0.7955399 0.0637685 12.475 < 2e-16 ***

I(t^2) -0.0041187 0.0007103 -5.799 1.65e-07 ***

seasonal_I2 1.7177908 1.8014987 0.954 0.343510

seasonal_I3 8.5584096 1.8691776 4.579 1.91e-05 ***

seasonal_I4 6.6796790 1.8690680 3.574 0.000633 ***

seasonal_I5 8.5863287 1.8690137 4.594 1.81e-05 ***

seasonal_I6 12.2326445 1.8690050 6.545 7.54e-09 ***

seasonal_I7 8.4214835 1.8690354 4.506 2.50e-05 ***

seasonal_I8 6.9928457 1.8691016 3.741 0.000365 ***

seasonal_I9 10.3395882 1.8692037 5.532 4.84e-07 ***

seasonal_I10 9.9674253 1.8693449 5.332 1.07e-06 ***

seasonal_I11 11.6835000 1.8695317 6.249 2.59e-08 ***

seasonal_I12 17.9206692 1.8697737 9.584 1.72e-14 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 3.603 on 72 degrees of freedom

Multiple R-squared: 0.9326, Adjusted R-squared: 0.9204

F-statistic: 76.58 on 13 and 72 DF, p-value: < 2.2e-16

Call:

lm(formula = z ~ t + seasonal_I)

Residuals:

Min 1Q Median 3Q Max

-10.8562 -2.2938 0.1567 2.6730 9.3951

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 21.98000 1.73500 12.669 < 2e-16 ***

t 0.43721 0.01893 23.097 < 2e-16 ***

seasonal_I2 1.71779 2.16697 0.793 0.430512

seasonal_I3 9.21741 2.24422 4.107 0.000103 ***

seasonal_I4 7.37163 2.24366 3.286 0.001566 **

seasonal_I5 9.30299 2.24326 4.147 8.98e-05 ***

seasonal_I6 12.96578 2.24302 5.780 1.72e-07 ***

seasonal_I7 9.16286 2.24294 4.085 0.000112 ***

seasonal_I8 7.73422 2.24302 3.448 0.000941 ***

seasonal_I9 11.07272 2.24326 4.936 4.88e-06 ***

seasonal_I10 10.68409 2.24366 4.762 9.47e-06 ***

seasonal_I11 12.37545 2.24422 5.514 5.03e-07 ***

seasonal_I12 18.57967 2.24494 8.276 4.26e-12 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 4.334 on 73 degrees of freedom

Multiple R-squared: 0.9011, Adjusted R-squared: 0.8848

F-statistic: 55.4 on 12 and 73 DF, p-value: < 2.2e-16

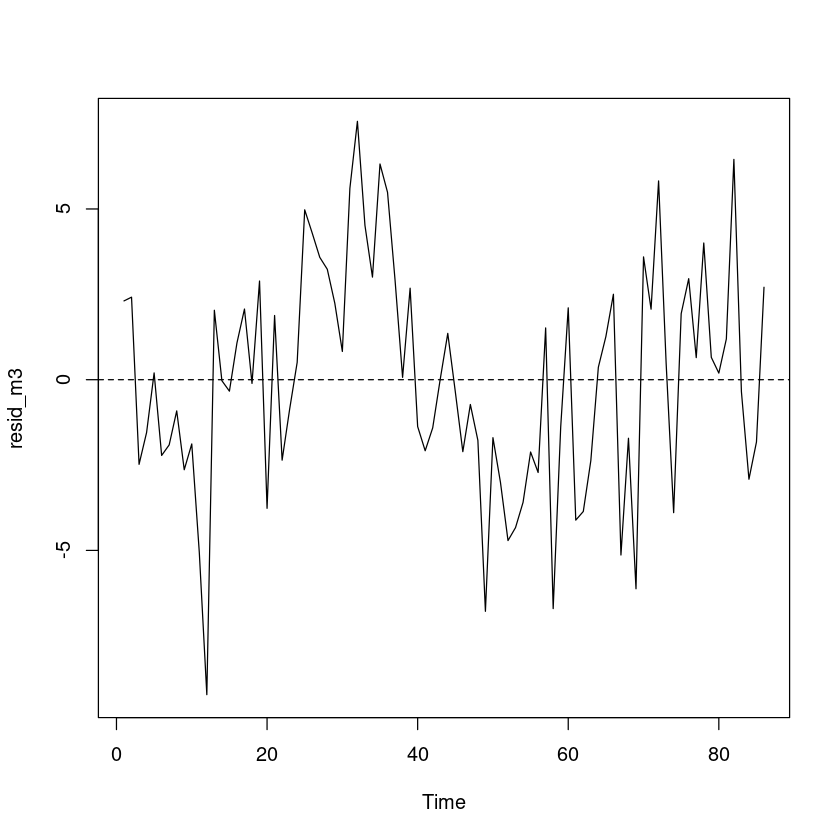

2차 추세도 유의하고, 수정된 결정계수의 값이 증가 하였기 때문에 2차 추세 모형 사용 가능

plot.ts (resid_m3)abline (h= 0 , lty= 2 )

One Sample t-test

data: resid_m3

t = -4.2693e-16, df = 85, p-value = 1

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-0.7109349 0.7109349

sample estimates:

mean of x

-1.526557e-16

studentized Breusch-Pagan test

data: m3

BP = 11.389, df = 13, p-value = 0.5783

Durbin-Watson test

data: m3

DW = 1.1633, p-value = 4.187e-05

alternative hypothesis: true autocorrelation is greater than 0